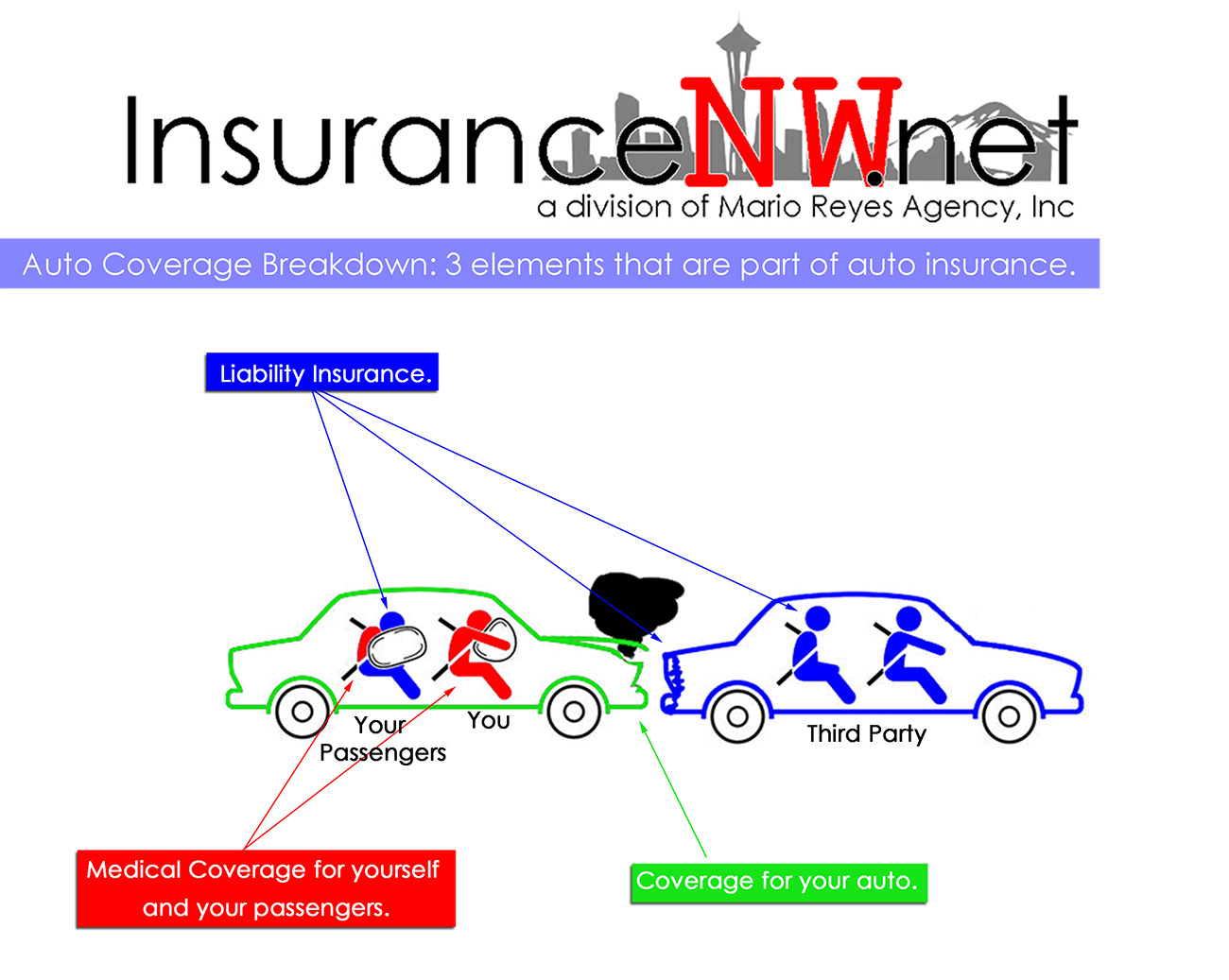

Liability Insurance will pay for third party medical expenses and propety damage.

Example of Medical expenses:

- Hospital visits (Medical diagnosis)

- Ambulance cost

- X rays, MRI

- Medical Treatment, including: massage, therapy, physical therapy, chiropractor visits, psychological therapy, etc

Typical expenses:

- Loss of Income

- Pain and suffering

- Lawyer fees

- Bodyshop repair

Other Expenses:

- School or Tuition fees

- Repayment of vacation expenses

- Other expenses directly related to accident

- Funeral expenses

How does liability insurance protect your assets?

If you are found to be responsible for an accident, the affected parties have the legal right to sue you for damages (Property, Medical, Etc.) The lawsuit against you falls in the hands of your insurance company who becomes responsible to pay; according to the law and the limits on your policy, taking the weight of your shoulders of having to pay any money out of your pocket. This is why it is so important to know your coverage limits since it is possible that the limits you chose on your policy may not be enough to cover all third party damages and any amount over that limit will become your responsibility at which point the affected party has the legal right to sue you over your (current and future) assets, including; Garnishment of your income and liquid assets.

What are the limits and how do they work?

Every policy and every coverage will have a specific limit of coverage, for auto insurance there are normally 2 ways to how these are represented:1) Split limits2) Combined Single LimitThe most common of the two is Split limits but let’s explore both these options, Starting with split limits:On your auto declaration page, you may see your liability limits split into 3 different amounts for example: 25/50/10. This represents in thousands how much money your policy would pay maximum for any given claim. In other words, the amounts you see mean this: $25,000 /$50,000/ $10,000The first two amounts correlate with medical expenses (25/50) and the very last one represents property damage (10).The amount in the middle ($50,000) is how much money the policy will pay in medical expenses for all injured people in the claim. The first amount is ($25,000) which represents how much money the policy will pay per person.A policy with 25/50 limits means that the policy will pay a maximum of $50,000 in medical expenses but no more than $25,000 per person.The last amount $10,000 is how much money the policy will pay in property damage; example: Auto damage, property damage, etc.Combined single limit:There is a one single amount that will pay for medical and property damage as needed up to the maximum limit selected. In other words, unlike split limits, combined single limit does not separate the coverage into sections.This type of limit is more commonly used for commercial policies.